self employment tax deferral due date

This policy outlines the principles guidelines and process for the self-funded leave SFL program of dept. I do not know my National Insurance number.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

So in the example above if Novak did not notify HMRC about his new self-employment until November 2022 as long as he completed and submitted a 202122 tax return online AND paid the tax due by 31 January 2023 he should not be charged any penalties for the late notification of his self-employment.

. Self-funded leave is not unlike sabbatical leave in that it allows indeterminate employees to defer up to 33 13 per cent of their gross salary or wages in order to fund a period of absence from their work and return to their regular employment when.

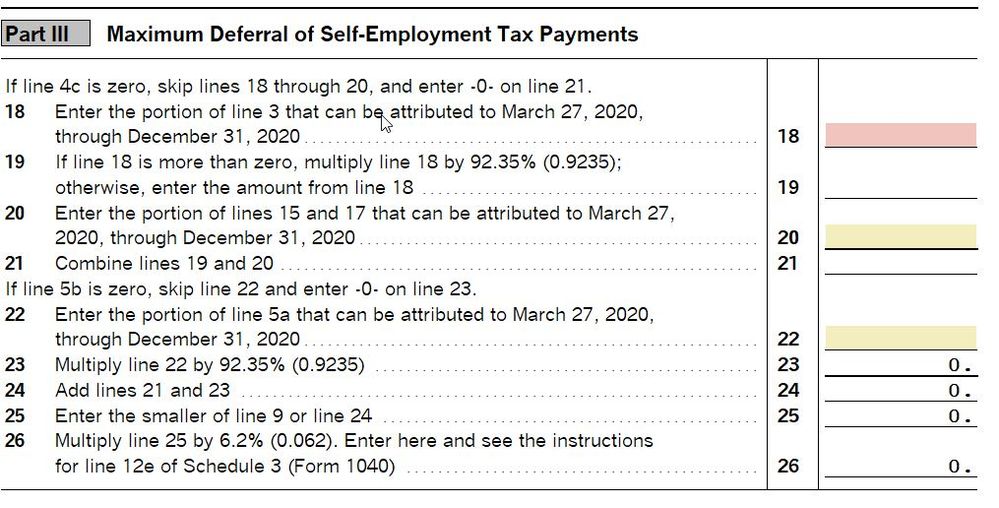

Guidance For Repayment Of Deferred Payroll Self Employment Taxes

How To Defer Social Security Tax Covid 19 Bench Accounting

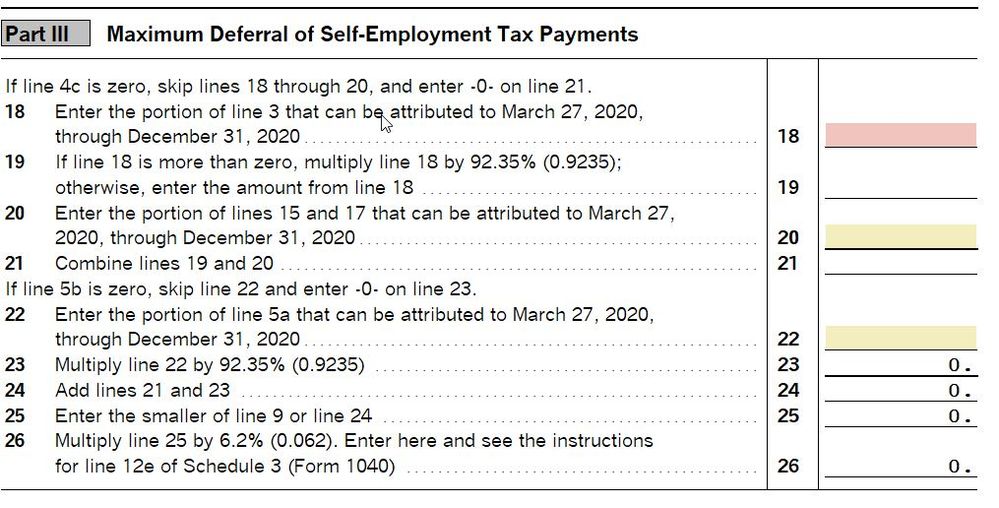

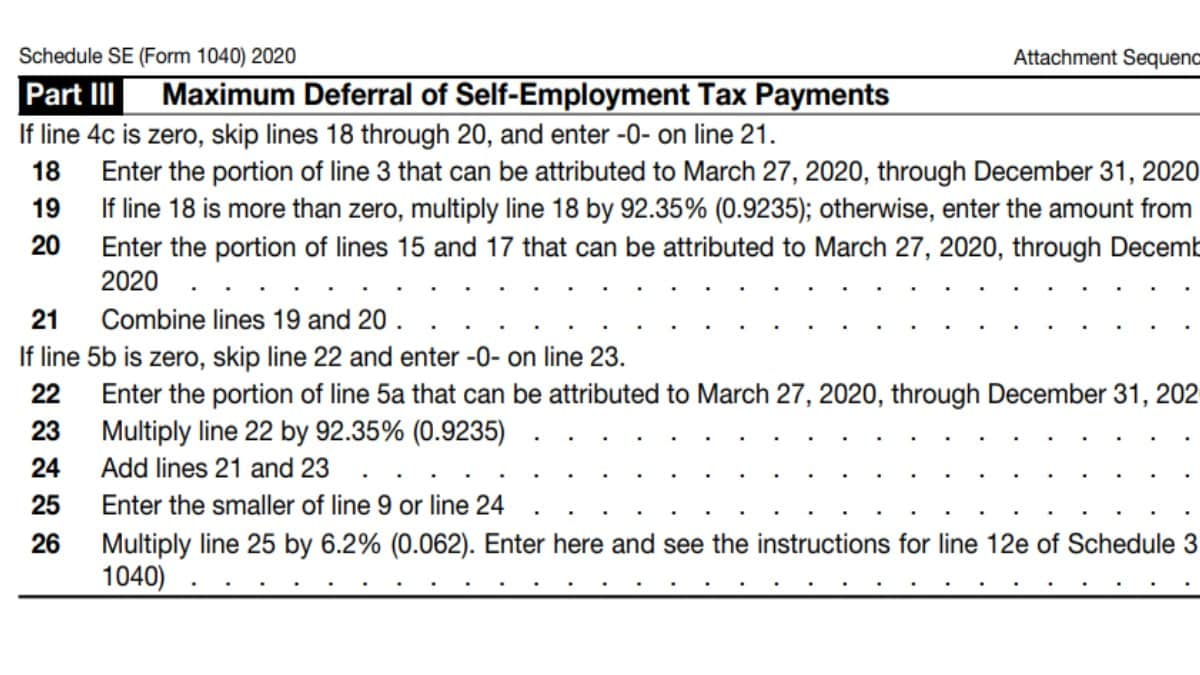

Max Deferral Line 18 Federal Income Tax Taxuni

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Self Employed Social Security Tax Deferral Repayment Info

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Self Employed Social Security Tax Deferral Repayment Info

Your Federal Payroll Tax Deferral Questions Answered Taxact Blog

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

Deferred Social Security Tax Payments Due By Jan 3 2022 Cpa Practice Advisor

Payroll Tax Deferral Deposits Due By Jan 3 2022 Baker Tilly

Deferral Of Se Tax Intuit Accountants Community

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia

What The Self Employed Tax Deferral Means Taxact Blog

Us Deferral Of Employer Payroll Taxes Help Center

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

Payroll Tax Deferral How Will It Affect You Experian

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community